As part of the Case for Quality program US FDA CDRH (Center for Devices and Radiological Health) have identified that an excessive focus on compliance rather than quality may divert resources and management attention towards meeting regulatory compliance requirements rather than adopting best quality practices. This is also related to low investment in automation and digital technologies, which could themselves greatly assist in quality improvements and process control. An important element of the program is to promote a risk-based, product quality and patient centric approach to computerized systems assurance. This encourages critical thinking based on product and process knowledge and quality risk management over prescriptive documentation driven approaches.

One of the prioritized medical device guidance documents that the Agency intends to publish in FY 2019 ("A-list") is a draft entitled “Computer Software Assurance for Manufacturing, Operations, and Quality System Software”. These activities are of great significance to the industry and are aligned with the GAMP® risk-based approach as well as the wider ISPE patient-centric position and focus on cultural excellence.

The GAMP® Global Leadership strongly supports this patient-centric and quality risk-based approach to the assurance of computerized systems and believe that current ISPE GAMP® Guidance is already fully aligned and consistent with such an approach.

GAMP® also strongly supports the adoption of new and innovative computerized technologies and approaches throughout the product life cycle to support data integrity, product quality, patient safety, and public health.

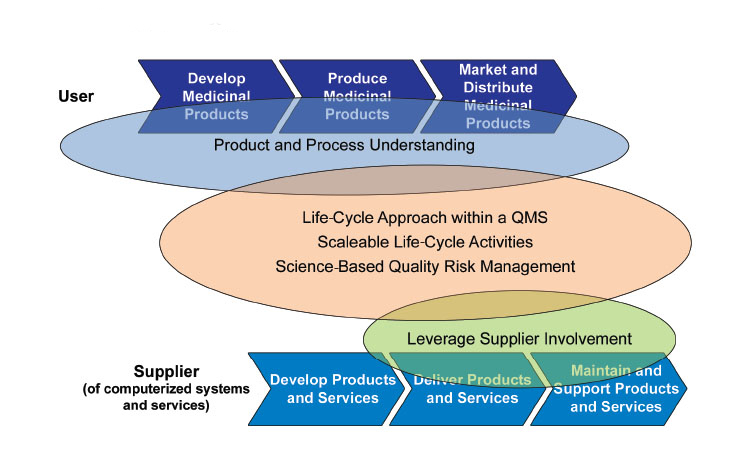

The main objective of GAMP® 5 is the effective achievement of patient safety, product quality, and data integrity. The Guide applies a life cycle approach based on Intended Use and Product and Process Understanding. The application of Quality Risk Management enables effort to be focused on critical aspects of a computerized system and risks to be effectively managed. Supplier activities and documentation should be leveraged wherever possible and unnecessary duplication and unnecessary activities should be avoided.

GAMP® 5 notes the need to avoid duplication of activities (e.g., by fully integrating engineering and computer system activities so that they are only performed once), to scale all life cycle activities and associated documentation according to risk, complexity and novelty, and to leverage supplier activities wherever possible.

GAMP® supports the use of incremental, iterative, and evolutionary approaches including Agile, for product development and development of custom applications. Note that success factors for this include a robust Quality Management System within an appropriate organizational culture, well-trained and highly disciplined teams following a well-defined process supported by effective tools and automation, and proper customer or product owner involvement.

GAMP are communicating this position by various means, including an article in Pharmaceutical Engineering Magazine and a Concept Paper.

In the pharmaceutical industry, which is highly regulated, aseptic processing is a critical component that ensures the sterility of products. Regulators have a set of comprehensive requirements that minimize the risk of contamination. Regulators set the requirements; however, the industry has an obligation to the patients who rely on and expect a drug that is safe and free of contamination....

Like any investment in digital manufacturing systems, demonstrating business payback before and after investment is critical to getting MES projects approved and verifying profitability after investment. Whether it is introducing MES, expanding it to additional sites, switching software, upgrading existing software, or developing electronic production records (EPR) for new drug products,...

Sustainability is emerging as a pivotal force influencing the pharmaceutical industry’s dynamics and steering companies towards transformative change. The focus of this analysis is to delve into the sustainability key performance indicators (KPIs) of prominent pharmaceutical players, namely Pfizer, Sanofi, Glaxo Smith Kline (GSK), Becton Dickinson, Johnson & Johnson, Abbott, Eli Lilly, and...